Market overviews

•

Nov 4, 2025

The Scorecard

Survival was high, but breakouts were rare in the 2020 YC batch.

Highlights

7 Unicorns Created: Supabase ($5B), WhatNot ($4.97B), Zip ($2.2B), Jeeves ($2.1B), Pave ($1.6B), Airbyte ($1.5B), PostHog ($1.4B)

~80% Success Rate: 348 startups are still active or acquired

~33% Reached Series A+: 142 startups hit institutional funding milestones post-YC

21 startups hit $100M+ Valuations: Top 5 startups account for ~$16B in combined valuation

Most value is concentrated in a handful of startups.

The top 21 startups (4.8% of the batch) achieved valuations of $100M or more. Leading the pack: Supabase at $5B, WhatNot at $4.97B, Zip at $2.2B, Jeeves at $2.1B, and Pave at $1.6B.

2/3 of the surviving startups haven't raised beyond Seed.

~80% of startups remain active or were acquired (276 active, 72 exits). But only 132 startups raised Series A or beyond. That means 2/3 of surviving startups haven't hit institutional funding milestones five years in.

Alma Matters: Where founders came from

Seasoned professionals (avg. 8+ yrs experience), advanced degrees, and global alma maters (Stanford, MIT, IITs, Oxbridge) defined the YC 2020 founder profile.

YC 2020 was a cohort of seasoned professionals and domain experts, not fresh grads.

The average founder was ~37 years old in 2020, and nearly 3/4 were over ~30. Only 5% were under ~25. On average, they brought ~8 years of professional experience, highlighting the program’s tilt toward professionally accomplished talent.

Technical founders were well represented, but not the majority.

The cohort had a healthy balance of technical builders and business operators. About ~46% of the founders had engineering or CS backgrounds, while the rest came from business, economics, and other analytical disciplines.

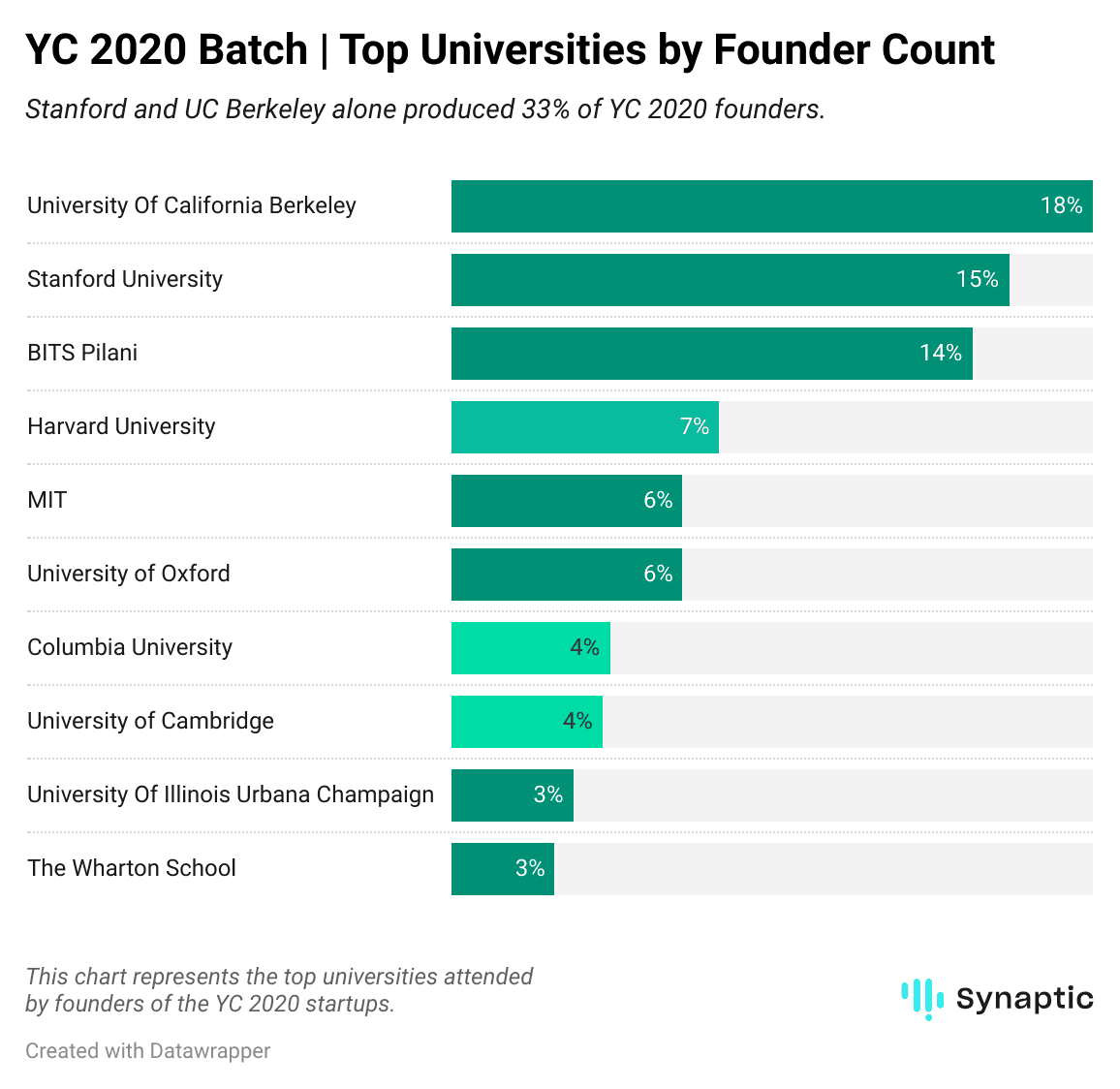

Elite schools produced most of the 2020 founder pool.

UC Berkeley and Stanford led by a wide margin, cementing their status as YC’s most reliable talent pipeline, with India's BITS Pilani following suit.

Interestingly, ~61% of startups in the batch had two or more co-founders from the same university, highlighting the importance of shared academic networks.

Most founders held advanced degrees.

Nearly ~70% of the founders had graduate or advanced degrees, including Master’s (29%) and PhDs (11%). Only 4 in 10 held just an undergraduate degree, reflecting a highly educated, professionally seasoned founder pool across science, business, and engineering.

Breakout Stars

Highest Valuation: Supabase

Open-source Firebase alternative that went from YC S20 to a $5B valuation in under five years. Raised $496M from Accel, Peak XV, Coatue, and Y Combinator. Now serves 4M+ developers across startups and enterprises.

Most Capital Raised: WhatNot

Livestream shopping platform that raised $265M Series E to reach a $4.97B valuation. Started with Funko Pop figures during YC W20, expanded across collectibles. Processes $3B+ in annual GMV with 1k+ employees across entertainment, trading cards, and sneakers.

Most Capital Efficient: PostHog

Open-source product analytics that grew from $920M to $1.4B valuation in just ~6 months. Recently raised $75M Series E led by Peak XV. Known for developer-first analytics with session replay and A/B testing, now powering 176K+ companies.

Category Creator: Zip

Procurement platform that created "orchestration" as a category and became IDC's first recognized Leader. Raised $371M to hit $2.2B valuation. Known for bringing consumer-grade UX to enterprise buying, processing $107B in spend (2024) for Snowflake, Coinbase, and Northwestern Mutual.

SPAC to Acquisition: Pardes Biosciences

COVID-19 antiviral developer that went public via $274M SPAC merger with Foresite Capital in December 2021. Traded on Nasdaq (PRDS) before being acquired by MediPacific for $130M in August 2023. Strategic backing from Gilead Sciences.

The ~3% Who Pivoted

Nearly 3% of the surviving startups (9 out of 348 active or acquired) publicly documented their pivots. Of the lot, two achieved Unicorn status, and 100% are still operating.

Most pivots stemmed from post-COVID funding realignments and the growing intersection of AI, SaaS, and fintech around 2023.

Early, rapid pivots based on direct user feedback led to the strongest outcomes.

PostHog and Airbyte, for instance, pivoted multiple times during the YC cohort, treating each customer conversation as a validation test.

PostHog (YC W20)

Pivoted 6 times in 6 months before landing on open source product analytics. The final pivot came during the YC batch when founders got frustrated re-implementing analytics for each failed idea. Launched on Hacker News with just a 4-week-old MVP, and two weeks later, they'd crossed 1,500 stars on GitHub. Now valued at $1.4B with 100+ employees.

Airbyte (YC W20)

3 pivots in the first month alone. Started as a data exchange platform, shifted to a data integration engine, then on-premise Segment alternative, finally landing on an open source ELT platform. Each pivot happened within days based on customer feedback. Now has 90+ employees and 350+ connectors as the leading open source data movement platform.

The YC 2020 Batch: Where are they now?

Having crossed $5B in valuations, WhatNot and Supabase are well-positioned for public market exits. Many fintech and dev infra players are also scaling rapidly, setting up the batch for multiple billion-dollar outcomes in the coming years.

You've seen 16. See all 437 startups now.

Explore the full 2020 batch to uncover metrics like total funding, valuation, headcount, GitHub traction, and more across all 437 startups.

Perfect for VCs benchmarking portfolios, founders researching comparable trajectories, or anyone tracking YC outcomes.