Market overviews

•

Dec 16, 2025

The Scorecard

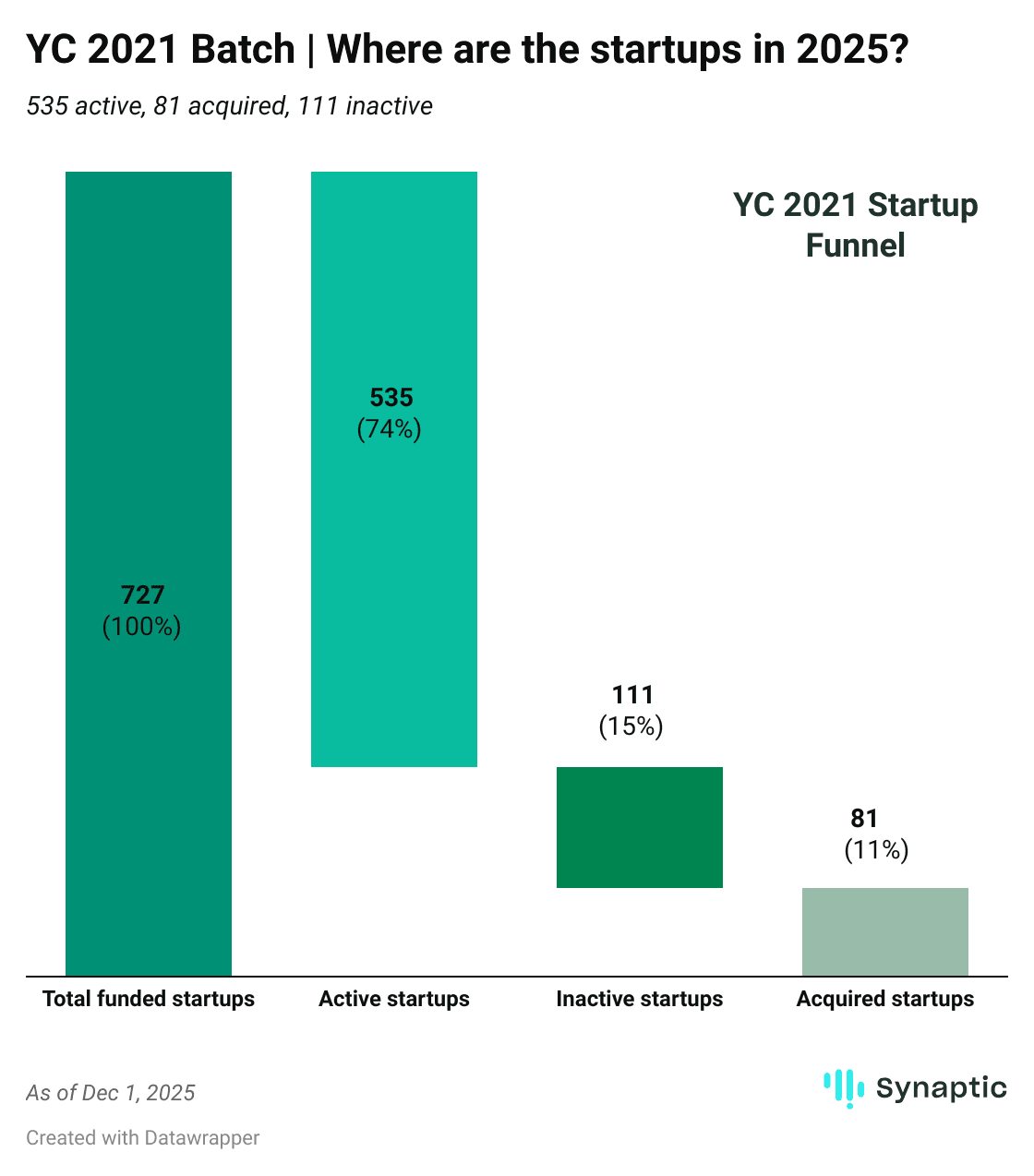

74% of startups (535) remain active four years later, while 11% (81) have already been acquired. Historically, 25% to 50% of YC startups are acquired over a 10-year horizon, indicating the cohort is still early in its exit cycle.

~4 Unicorns created: Zepto ($7B), Stokes Space ($2B), Onebrief ($1.1B), Nourish ($1B)

~84% Success Rate as of now: 612 startups are still active or acquired

~19% Reached Series A+ in four years: 138 startups hit institutional funding milestones post-YC

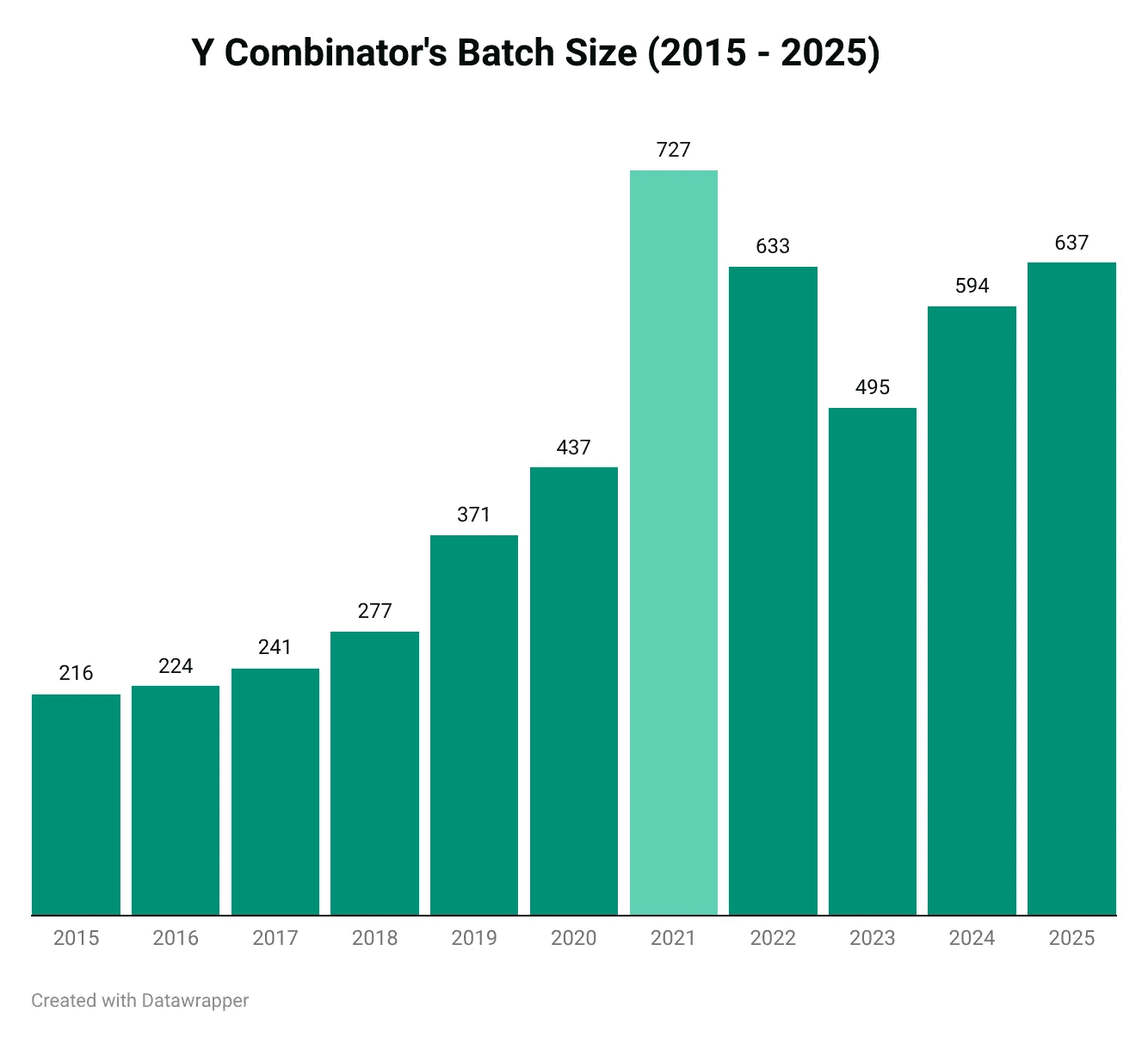

The 2020 batch clocked in 80% survival rate after five years (276 active + 72 acquired), while the 2021 batch hit 85% after four years (535 active + 81 acquired). Despite being larger and younger, the 2021 cohort shows slightly stronger early survival.

Despite higher survival, fewer YC 2021 startups advanced to Series A+.

The rate dropped from ~33% in 2020 to ~19% in 2021, despite the 2021 batch being 66% larger (727 vs 437 startups). However, 2020 had 5 years to mature, and market timing differs: the 2021 cohort launched during peak funding but hit the 2022-2023 correction shortly after.

Want the full breakdown? Download the complete YC 2021 performance dataset here.

Alma Matters: Where Founders Came From

Half of the YC 2021 founders were based in the US, while the other half came from abroad, highlighting YC's expanding global reach.

YC 2021 founders were seasoned professionals with advanced degrees.

53% of founders held advanced degrees and brought 9 years of experience on average. In comparison, YC 2020 attracted founders with 8 years of experience on average, and about 40% held advanced degrees (MBAs, PhDs, Master's).

The 24-34 age range remained the same. However, the 2021 batch featured founders with stronger technical and business credentials.

Around ~48% came from CS or engineering backgrounds, while business, economics, and other analytical fields made up the remainder.

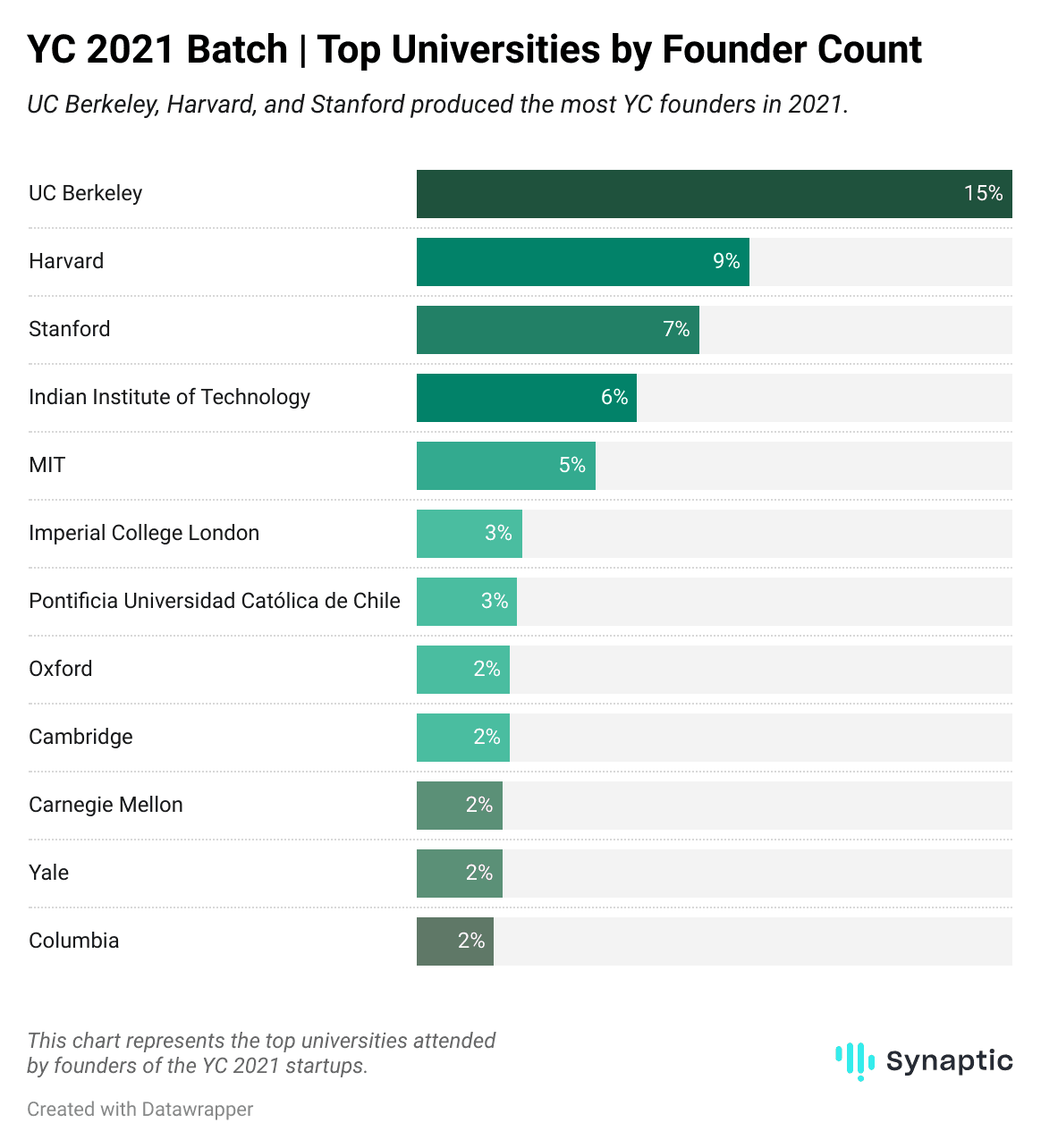

Similar to the 2020 batch, most of the YC 2021 founders came from elite schools.

15% of all founders came from UC Berkeley, making it the single largest talent source by a significant margin, followed by Harvard (9%) and Stanford (7%).

However, only 3 non-US institutions (IIT, Imperial, Pontificia) broke into the rankings, showing YC's founder pool skews towards the US despite its global applicant base.

The Four-Year Journey: Capital Raised, Value Created

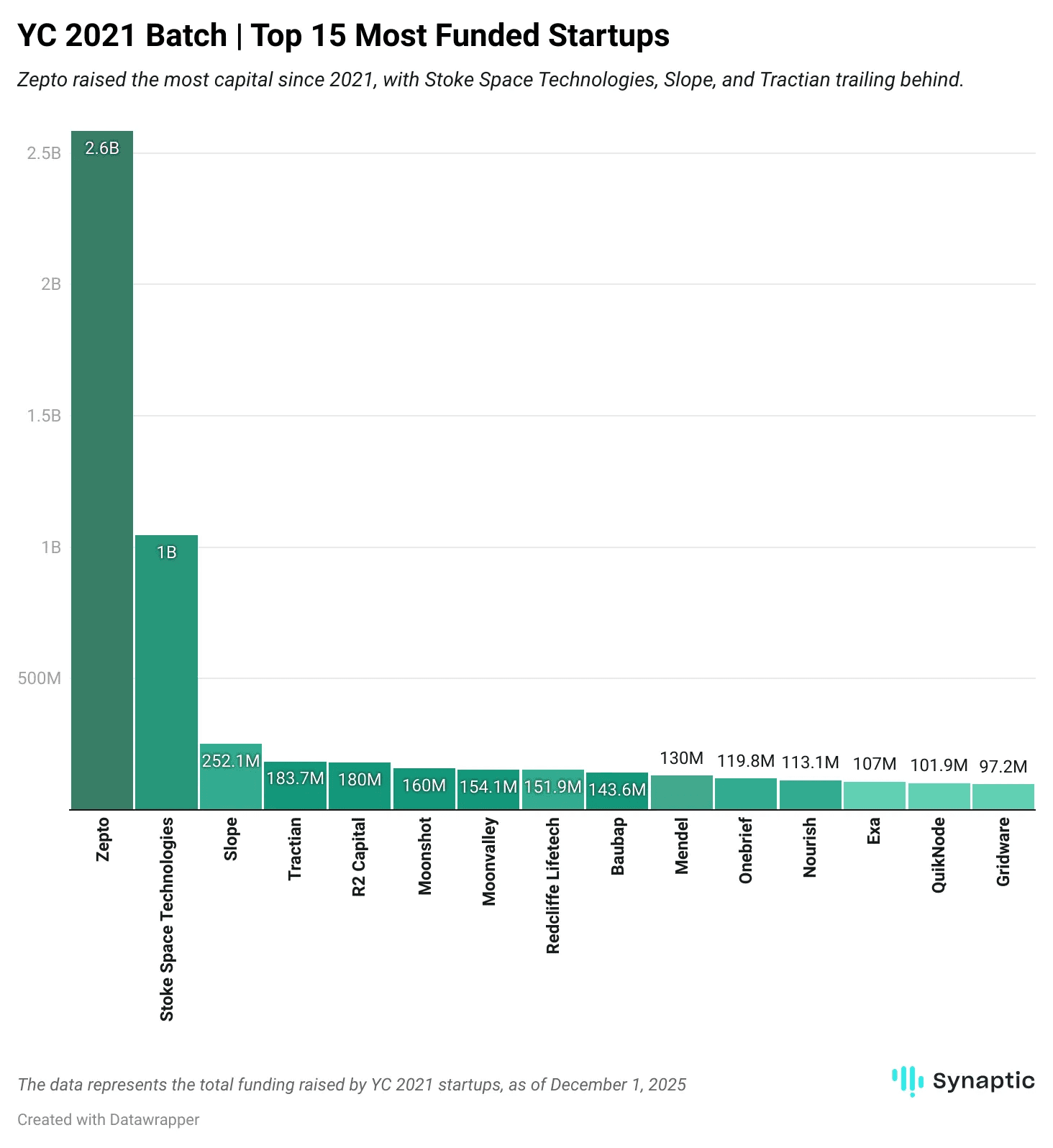

Zepto raised $2.6B, more than double any other YC 2021 startup.

Stoke Space follows at $1B, while Slope ($252M), Tractian ($184M), and F2 Capital ($180M) round out the top five.

Despite high survival, only three companies broke past the $200M mark.

The majority cluster tightly between $100M and $180M, suggesting only a few startups have secured large late-stage rounds. The third-largest company, Slope, has raised ~$252M, highlighting a cliff between breakout winners and the rest of the cohort.

In comparison, 2020 produced multiple large fundraisers: WhatNot ($749.7M), Supabase ($496.1M), Jeeves ($443M), Balance ($431M). Capital was also more evenly distributed across the top performers, with several companies approaching the half-billion mark rather than one big player.

The YC 2021 Batch: Where are they now?

Leading the charge is Zepto, which is heading to the public markets with a $7 billion valuation. It is one of India's fastest-growing companies to IPO.

Stoke Space ($2B), Onebrief ($1.1B), and Nourish ($1B) have also hit unicorn status, marking four billion-dollar outcomes so far. However, four years later, only a few companies are carrying the upside, while most are still early-stage.

Name | Website | Status | Category | Location | Total Funding Amount | Last Known Valuation | Synaptic Growth Index (Dec 25) |

Zepto | zepto.com | Active | Consumer | India | 2.58B | 7B | Rapid Growth |

Stoke Space | stokespace.com | Active | Industrials | United States | 1.05B | 2B | Fast Growth |

Slope | slopepay.com | Active | Fintech | United States | 252.1M | Not publicly disclosed | Flat |

Tractian | tractian.com | Active | Industrials | United States | 183.7M | 720M | Fast Growth |

R2 | r2.co | Acquired | Fintech | Mexico | 180.0M | 100M | |

Moonshot Brands | moonshotbrands.com | Acquired | Fintech | United States | 160.0M | Not publicly disclosed | Flat |

Moonvalley | moonvalley.com | Active | Consumer | Canada | 154.1M | Not publicly disclosed | Flat |

Redcliffe Lifetech | redcliffelabs.com | Active | Healthcare | India | 151.9M | Not publicly disclosed | Steady Growth |

Baubap | baubap.com | Active | Fintech | Mexico | 143.6M | 1.1M | Flat |

Mendel | somosmendel.com | Active | Fintech | Mexico | 130.0M | Not publicly disclosed | Steady Growth |

Onebrief | onebrief.com | Active | B2B | United States | 119.8M | 1.1B | Fast Growth |

Nourish | usenourish.com | Active | Healthcare | United States | 113.1M | 1B | Fast Growth |

Exa | exa.ai | Active | B2B | United States | 107.0M | 700M | Steady Growth |

QuickNode | quicknode.com | Active | B2B | United States | 101.9M | 800M | Flat |

Gridware | gridware.io | Active | Industrials | United States | 97.2M | Not publicly disclosed | Steady Growth |

You've seen 15. See all 727.

Explore the full 2021 batch to uncover metrics like total funding, valuation, headcount, GitHub traction, and more across all 727 startups.

Perfect for VCs benchmarking portfolios, founders researching comparable trajectories, or anyone tracking YC outcomes.