Market overviews

•

Jun 11, 2024

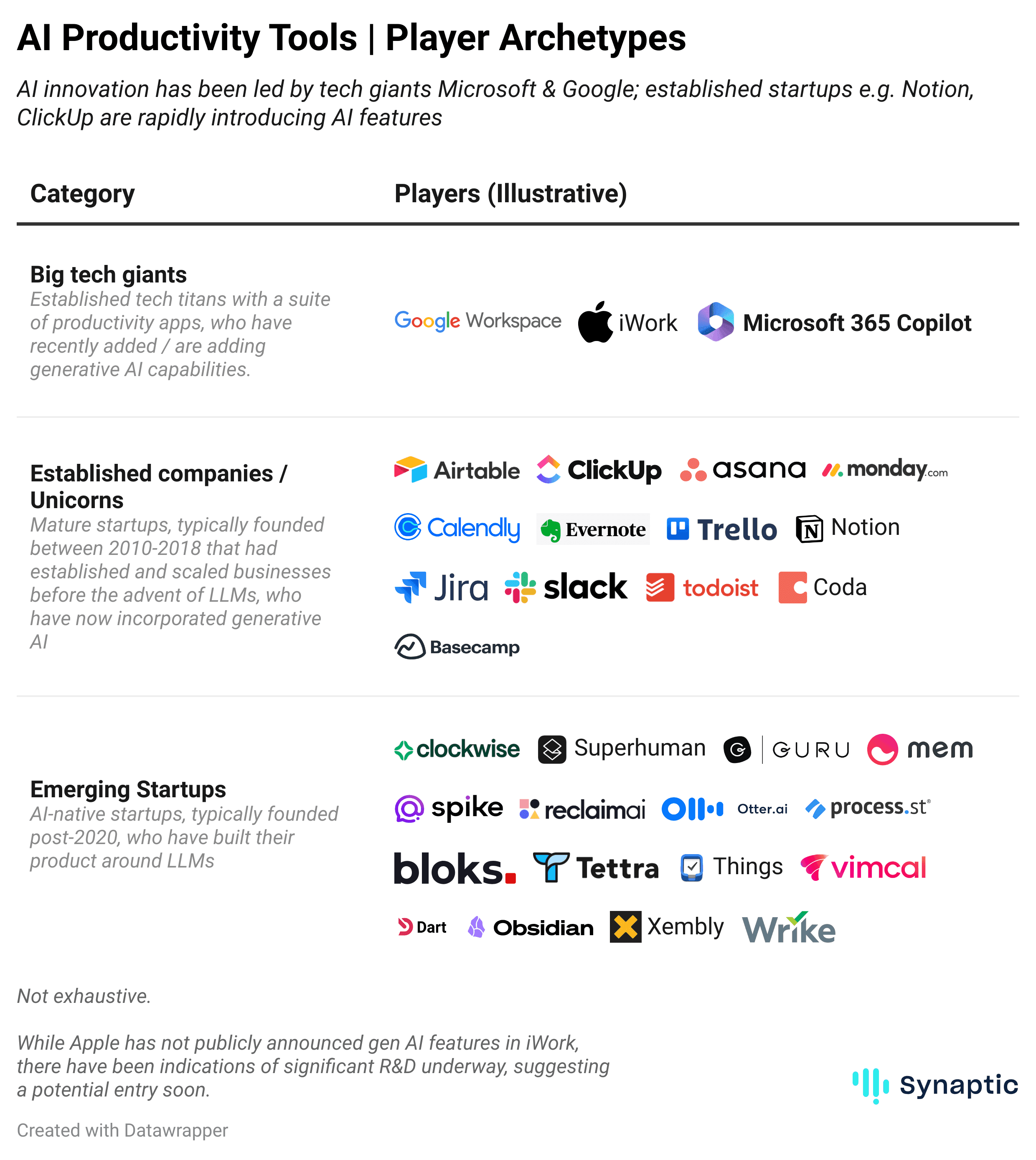

Player Archetypes: Highly competitive space with big tech giants, unicorns, and startups innovating with AI

Microsoft vs Google is the defining battle in AI-enabled workspace, while Apple’s entry is anticipated

Microsoft has been a pioneer for generative AI in this space, with the launch of Microsoft Copilot – an AI-powered assistant integrated into Windows 11, Microsoft 365, and Edge and Bing web browsers to offer personalized, context-aware assistance based on web intelligence, work data, and user's PC activities.

Google is following suit by embedding generative AI into its Workspace via Duet AI – which will offer features like drafting responses in Gmail with minimal prompts, generating original images from text in Google Slides, automating data classification in Google Sheets, etc. – simplifying tasks and enhancing efficiency across professional and personal contexts.

The core AI features that Microsoft and Google offer in their productivity tools will determine the battlefield where startups innovate in the long run - downstream use-cases from those core features. While Apple remains silent on introducing generative AI to iWork, there are strong indications of intensive R&D underway, suggesting a potential entry in the near future. It’ll be interesting to see which tech giant can more seamlessly integrate gen AI and deliver value through their respective platforms.

Broadly two types of interfaces are emerging – assistants and agents

AI Assistants - Provide answers, information, summaries or content based on a prompt, with knowledge and information of your personal context. The user can subsequently use the information provided by the assistant to execute their tasks. Examples of these tools include chatbots (ChatGPT), virtual knowledge assistants (Mem.ai), and AI search engines (You.com).

AI Agents - These tools perform tasks directly through integrations with other tools (like calendar apps, email clients etc.) based on the user’s instruction. Agents typically break tasks down into multiple steps and carry out a series of API calls to LLMs execute them. Examples of these tools include task automation apps (Bloks), scheduling agents (Vimcal.com), or email/communication agents (Sixty AI).

AI Assistants are more established, since they enable a layer of human oversight. While the idea of AI agents is exciting; they are still largely unproven and expensive - assigning tasks to agents without human oversight is not entirely reliable until the LLMs reach a certain threshold of accuracy.

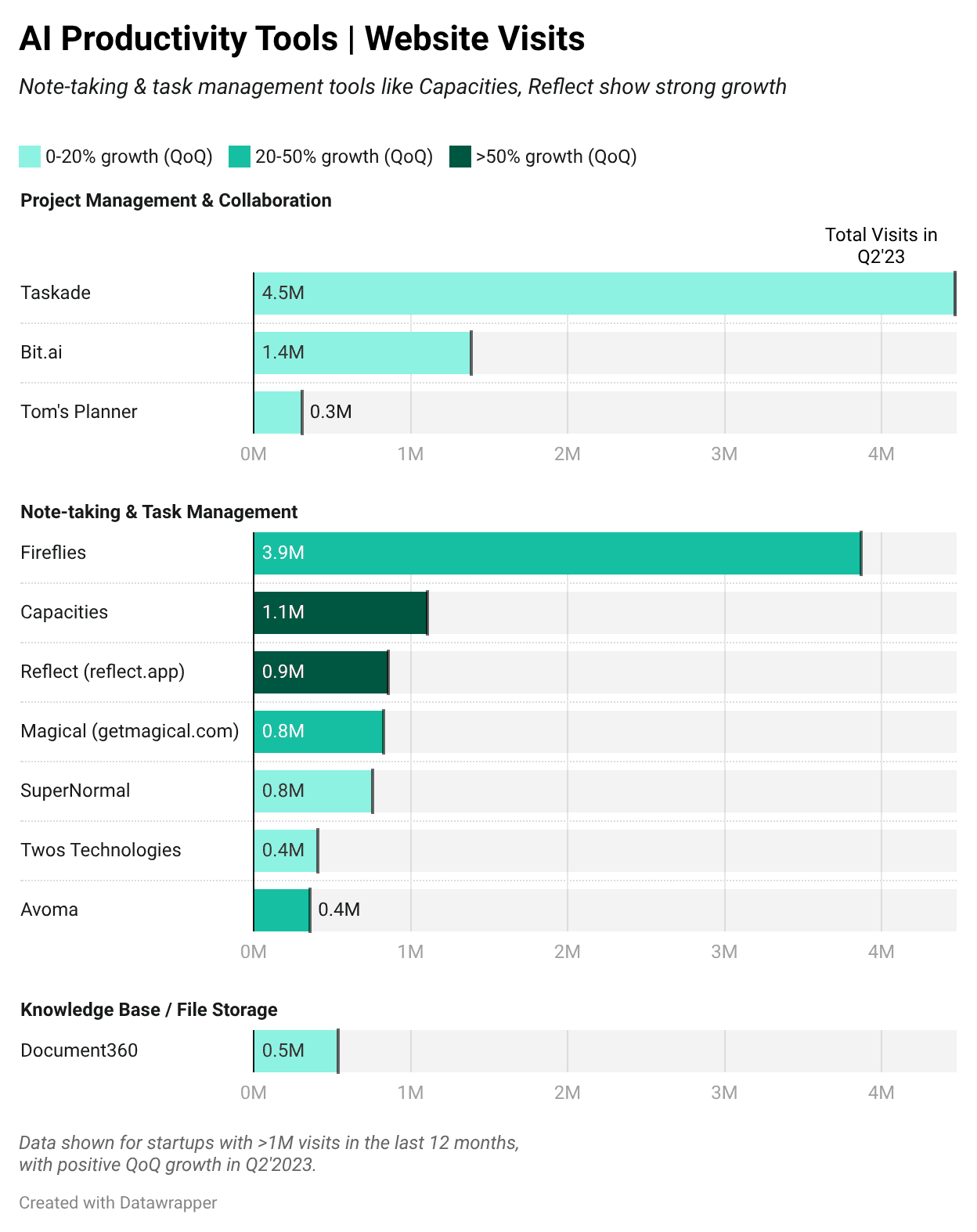

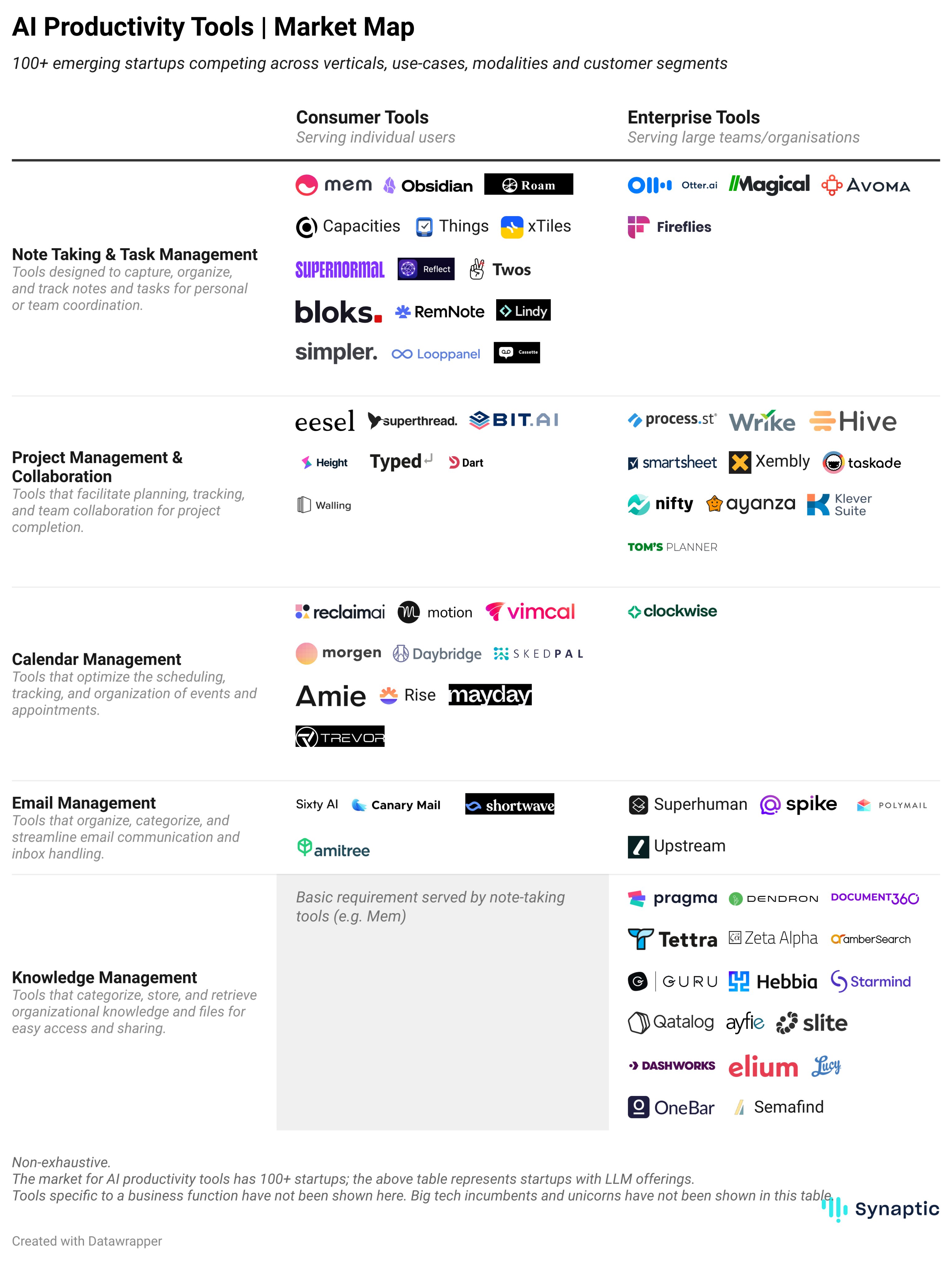

Market: 100+ tools competing across use-cases, verticals, modalities, and customer segments

A highly competitive landscape with 100+ tools; the typical growth path for startups is to iterate in the prosumer market and eventually graduate to enterprise

Similar to the AI video tools (~50 AI-native startups) sector, the AI productivity tools sector has a large lower-end market with a diverse set of individual / SMB use cases - an ideal building ground for startups to build market presence, iterate on product and eventually break into enterprises. Productivity tools, in particular, has been a space where the individual usage can drive enterprise sales. Unicorns like Notion, Airtable and many others started out serving individuals, building a strong product which those individuals eventually pitched to their employers

New startups are building for niches across verticals, use-cases and modalities

Vertical focused: Tailoring AI solutions for specific sectors like healthcare (DeepScribe) or academic learning (RemNote), ensuring domain-specific accuracy and relevance.

Use-Case focused: Concentrating on particular needs, such as tools exclusively designed for transcribing meetings (Otter.ai), brainstorming sessions (xTiles) or scheduling calendar events (Reclaim.ai).

Cross modalities: Some startups are focusing on text-based summaries, like Mem.ai, while others, like Fireflies.ai, are venturing into A/V + text-based solutions, catering to diverse user preferences.

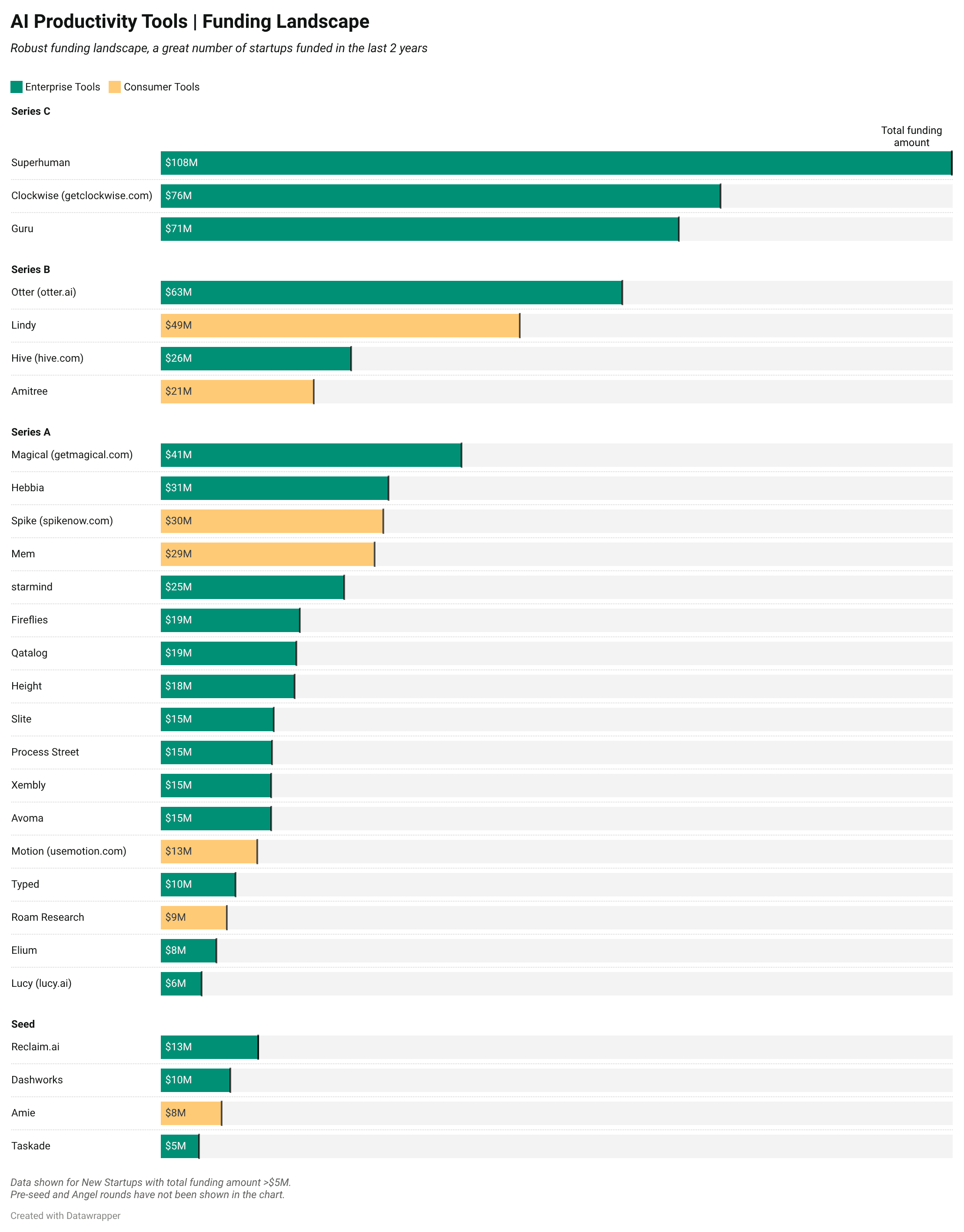

Funding Landscape: Active funding across stages, enterprise tools attract the maximum capital

A robust funding landscape over the last 2 years, with several deals across stages from Pre-seed to Series F

Over 70% of the funded startups in the space received their funding in the last 2 years. Investors are placing active bets on new, AI-native startups.

~65% of the funded new startups have received over $5M of funding. Additionally, there are 10+ startups in the pre-seed and angel round stages.

Mature startups / unicorns like Airtable, Clickup, Calendly and Coda have received >$200M of funding.

Enterprise tools are attracting the maximum share of funding dollars

~75% of the funding for new startups has gone to the ones focussed on enterprise use-cases. This is to be expected – as discussed earlier, the typical growth trajectory for startups is to graduate to enterprise users after serving prosumers. Once integrated into enterprise systems; these tools become indispensable to organizational workflows, making them sticky and thus attractive for investment.

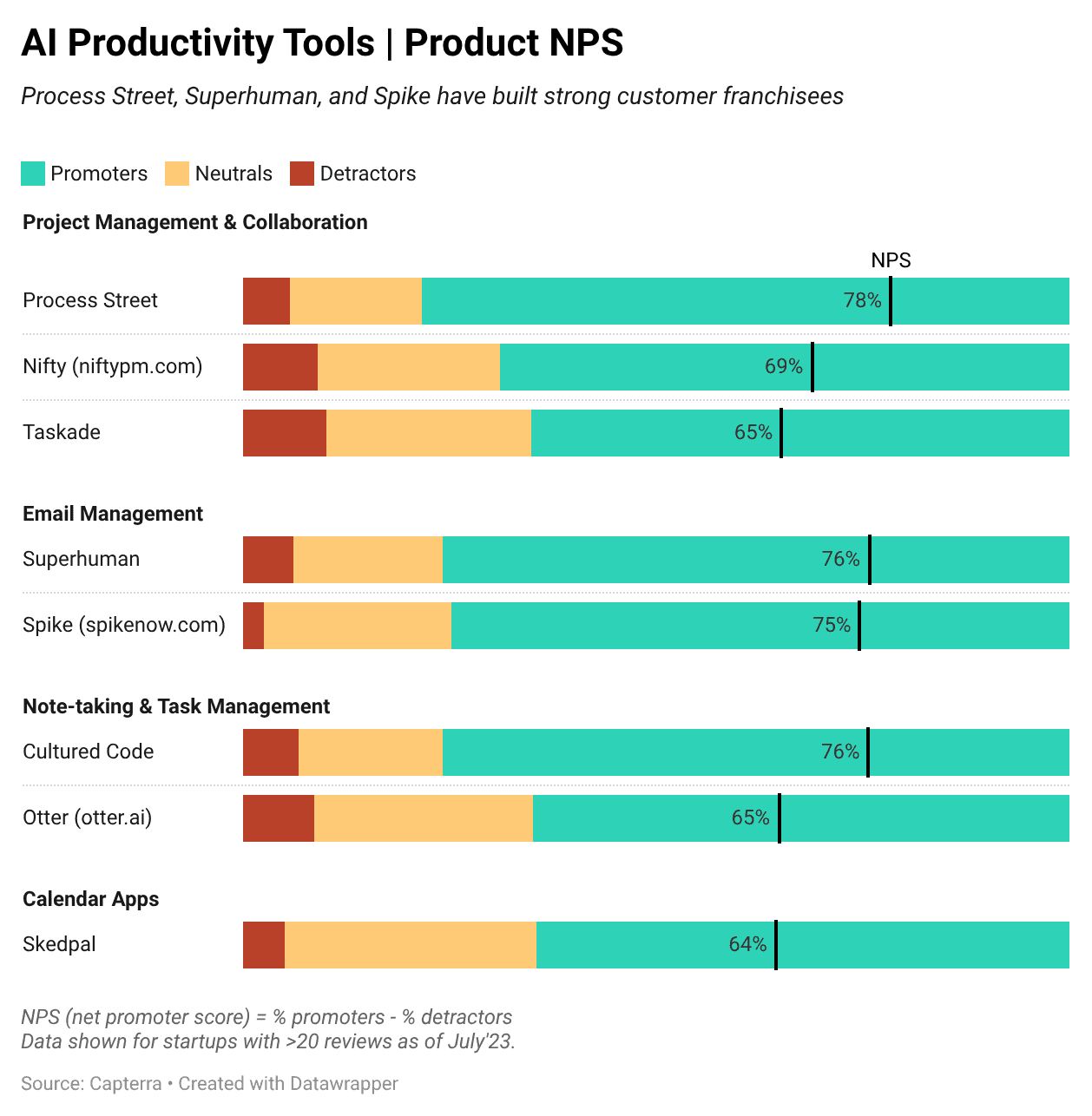

Product Reviews: Process Street, Superhuman, and Spike standout as product leaders

Process Street is a versatile process management platform which boasts of enterprises clients like Salesforce, Spotify, Airbnb, Drift and 3000+ other businesses. Process Street's AI WorkFlow Generator creates tailored workflows with built-in timelines, task allocation, and approval processes. The platform also provides AI-generated task instructions, drafts emails, and allows customization and integration with other tools such as Slack, Trello, and Zapier, helping to tackle common business challenges and enhance operational efficiency.

Superhuman is a popular email client for productivity, known for its extremely loyal customer base. Superhuman aims to be the “fastest email experience” created, and the tool is known to propagate Merlin Mann’s idea of “Inbox Zero” by triaging the inbox quickly and effectively. Superhuman AI, powered by ChatGPT, is capable of generating emails that match the tone and voice of the user, auto-correct realtime, polish writing, and research pretty much anything which might help you write the email, within the platform itself. Some of Superhuman’s clients include organizations such as Spotify, Netflix, Uber, Notion, Dropbox, and Harvard.

Spike is a conversational email tool that turns inboxes into a chat-like experience, where emails are grouped by people and not threads/topics. Spike is preferred by many due to its unified inbox, which consolidates Gmail, YahooMail, Outlook, etc. Spike's Magic AI is capable of creating context-aware responses and summarizing lengthy emails. The Magic AI Bot acts as a AI chatbot within the inbox, which the user can feed prompts to for various requests, including question answering and code generation. Spike is used by teams at Spotify, Indeed, and Fiverr, amongst others.

Looking forward

Battle of the tech giants: Microsoft vs Google will define the future of an AI-enabled workspace

The battle between Microsoft’s and Google’s AI-enabled workspace offerings (and possibly Apple, once it announces AI features) will be the key in shaping the AI productivity landscape, determining which feature sets will become core / hygiene and which will be higher-order functionality where startups will innovate.

Highly competitive market with a multitude of tools, expect differentiation to be a challenge

The productivity tools market is large and highly competitive with relatively lower barriers to entry. While there is space for many players to play across varying needs and niches, achieving product-market-fit will be a challenge for many startups. Conversely, expect the intense competition to drive innovation at pace, especially in niche untapped segments (e.g. RemNote creating a study management solution for students).

Superhuman and Mem have emerged as popular tools, funding landscape will continue to remain active as the ecosystem matures

Superhuman and Mem have emerged as popular tools and are starting to see Enterprise adoption. Significant funding dollars have been channeled into the sector over the last 2 years and we expect that to continue as select startups gain traction and show signs of differentiation. Fireflies.ai, Spike and Taskade stand out as notable contenders for future funding deals.

Data privacy, accuracy will remain a concern

Generative AI working as a second brain comes with the condition of exposing considerable amount of personal data to train these models. Adoption of these tools might depend on regulatory frameworks on transparency of how the user’s data is being used. AI limitations such as inaccurate or hallucinated answers and outdated information will keep users wary of AI agents.