Data-driven Investor's Tech Stack 2024

If you are looking for a curated list of the best tools you will ever need to deal with the complexities of Venture Capital and Private Equity, keep reading! We have shortlisted the best tools to help you through deal sourcing, due diligence, portfolio management, and other complex and time-consuming processes. We will deep-dive into their functionalities, benefits, and how they can help you invest better. From core stack tools to general productivity and collaboration, these tools help you become data-driven and get insights into market trends, performance benchmarks, etc. You can also automate your workflows to save time and make investments with a high ROI.

Crafting Your Ultimate Venture Capital Data Stack

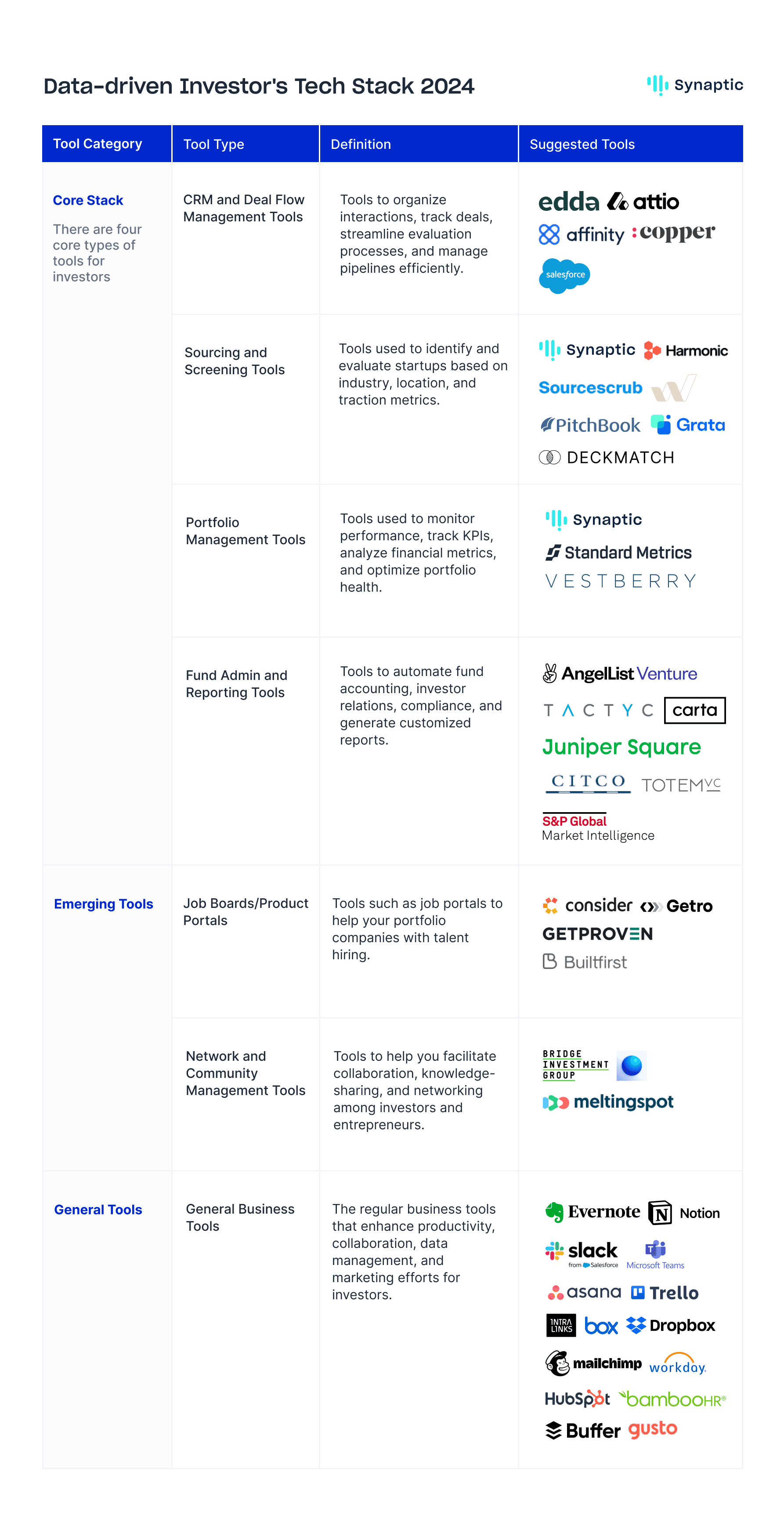

All these different data tools can be categorized into three broad categories based on their use cases across the deal flow cycle.

Core Stack Tools

The core stack consists of data and tools that drive the core fund operations and is built for private investors. Here are some key core stack tools (with examples):

CRM and Deal Flow Management Tools

These platforms streamline relationship management with entrepreneurs, investors, and other stakeholders while organizing deal flow from various sources.

Leading Tools

- Affinity — Geared towards account-based marketing (ABM), Affinity fosters targeted engagement and streamlines collaboration between marketing and sales teams. It facilitates the creation of targeted campaigns, automates lead scoring, and provides real-time insights into campaign performance.

- Edda — Edda offers integrated solutions for fund administration, deal flow management, portfolio oversight, and LP relationship management. It helps VCs to streamline administrative tasks and automate reporting processes. Real-time updates help monitor investments, communicate with founders, and generate detailed reports to keep LPs informed and engaged.

- Attio — Tailored for B2B sales, Attio offers opportunity management and sales forecasting. It can automate repetitive tasks, predict deal outcomes, and personalize outreach efforts using AI-powered features. For example — analyzing historical sales data to identify patterns and predict the likelihood of closing a deal based on specific customer interactions. This helps sales teams to prioritize high-potential deals and allocate resources effectively.

- Copper — Copper is a CRM platform for pipeline management and portfolio tracking. It automates tasks, captures important communications, and provides insights into deal progress and investor sentiment. Copper's integration with Google Workspace makes it a suitable option for VC firms that rely on Gmail and G Calendar for communication and collaboration. Its features include automatic contact creation from email interactions, easy deal tracking within Gmail, and real-time activity feeds.

- Salesforce — Salesforce offers customizable solutions for businesses of all sizes. Due to its comprehensive nature and scalability, it is a popular choice among large VC firms with complex investment processes.

Sourcing and Screening Tools

These tools aid in sourcing potential investment opportunities and conducting initial screening processes to identify promising ventures. To recognize a good sourcing platform, check if it provides the following three things:

- A well-built infrastructure so you don’t have to build it yourself.

- It has multiple data sources.

- It has a good UI that is easy to work with and executes your workflows smoothly.

- A large company database that covers a large number of companies of your interest.

- A people database that helps you find founders to discover companies at early stages.

- Multiple Integrated datasets with metrics that help compare and discover companies based on their performance. It also provides data models/composite scores that help in competitor identification.

- Good presentation and customization (if needed) of all the metrics, datasets, and analyses on the platform.

Here are a few reliable sourcing and screening platforms and tools:

Sourcing Platforms

- Synaptic — Synaptic provides signals on promising opportunities using company and people data. The platform consolidates 100+ company performance metrics across alternative datasets of your choice including employee and hiring data, funding history, website and app data, product ratings, and more. Their tagging system categorizes companies into 25,000+ business models and over 10 industry levels- making targeted searches easier! Synaptic also houses millions of talent and founder profiles and delivers signals on talent movements and interesting founders. This helps in sourcing hidden early-stage companies. The platform offers AI/ML-powered insights and automated alerts on companies of interest. Some well-known VC firms like GreenOaks, Ribbit Capital, Kingstreet, etc. are leveraging Synaptic for sourcing companies of interest.

- Harmonic — Harmonic’s predictive modeling algorithms assess startup viability by analyzing market dynamics, competitive landscape, and founder backgrounds.

- Sourcescrub — Sourcescrub provides private market data, insights into the competitive landscape, and investment opportunities through a vast database and customizable search filters.

- Grata — Grata can be used for collecting and managing feedback. Its automated workflows facilitate reference communication and ensure a consistent reference-checking process.

Sourcing Tools

- PitchBook — PitchBook is a sourcing and screening tool for VCs and PEs. Users can search for investors, companies, and deals, identify potential investment opportunities, and connect with relevant individuals.

- Wokelo — Wokelo helps build talent communities and foster long-term relationships with potential candidates. Its engagement features allow nurturing relationships through personalized content and events, keeping your talent pipeline warm and engaged.

- Deckmatch — Specializes in matching startups and investors, connecting early-stage companies with suitable funding sources. Its intelligent algorithms analyze startup profiles and investor preferences to facilitate relevant connections, accelerating fundraising.

Portfolio Management Tools

Dedicated to tracking and analyzing investment performance, these tools enable VC firms to manage their portfolios effectively.

The biggest problem with portfolio management is managing unstructured company updates. As an investor, you receive company updates in multiple formats including Excel sheets, emails, PDFs, Notion documents, etc. With no standardization, it can be tough to manage both — tracking every company in your portfolio and tracking potential companies in depth. Therefore, most VCs either limit the number of companies they track to only the most important ones or spend long hours manually compiling these reports.

An ideal portfolio management platform will scan and compile all these documents and let you track every metric for all the companies in your portfolio.

Some of the best Portfolio Management tools in the industry include:

- Synaptic — You can check out Synaptic’s PortfolioIQ where portfolio update files are automatically cleaned, tagged, and standardized into a ready-to-query database. You can audit any metric number in your dashboard and check the update to which it belongs, and how many times it has been restated in the report. You can benchmark startups/companies across any metric. These could be your portfolio companies or the companies you are tracking. The data is clean and refined- so you can build good forecasting and valuation models.

- Standard Metrics — Standard Metrics provides VC firms with real-time tracking of key indicators like IRR and portfolio diversification. Its intuitive dashboard and benchmarking features enable data-driven decision-making and transparent investor reporting, maximizing returns and accountability.

- Vestberry — Vestberry is a portfolio management tool for VC firms, streamlining investment management with automated cap table tracking and investor reporting. Its investor portal helps in efficient communication, enhancing transparency and trust.

Fund Administration and Reporting Tools

These platforms handle fund administration tasks such as compliance, accounting, and reporting to investors.

- AngelList — AngelList streamlines fundraising and investor management for early-stage startups and VCs. It simplifies investor onboarding, capital calls, and distribution management.

- Tactyc — Tactyc provides data visualization and portfolio performance reporting. It offers interactive dashboards and customizable reports that help VCs get real-time insights into their portfolio's health and performance.

- Totem VC — Totem offers specifically designed solutions for the needs of VCs. Its features include portfolio management, investor reporting, fund administration, and compliance tools.

- Carta — Carta provides equity management solutions. It also caters to VCs with its fund administration and reporting tools. It also facilitates secure cap table management, investor communication, and regulatory document management.

- Juniper Square — Juniper Square offers modern fund administration solutions for alternative investments, including venture capital funds. Its focus on automation and scalability allows VCs to manage complex portfolios efficiently.

- Citco — Citco offers financial services to investment management firms, including venture capital (VC) firms. It provides insights into portfolio performance, investor activity, and valuation analytics.

- iLevel S&P — iLevel S&P combines data and technology to provide fund administration and reporting solutions. It offers advanced analytics and reporting capabilities, allowing VCs to gain deeper insights into their portfolio performance.

Emerging Tools

Job Boards and Product Portals

Job boards help VCs find and recruit top talent for their firms. Product portals allow them to discover promising startups, understand their offerings, and potentially initiate investment conversations.

- Consider — Caters specifically to recruiting and placing senior-level talent within the venture capital industry.

- Getro — Getro helps find talent across various VC roles, from analysts to partners. Its VC-specific expertise ensures a tailored search and a successful match for VCs and candidates.

- Get Proven — Leverages data-driven algorithms to match VCs with required talent. It focuses on cultural fit and long-term career growth to ensure harmonious and successful team dynamics within VC firms.

- Builtfirst — Builtfrst caters specifically to early-stage VC firms and startups. They prioritize identifying highly motivated and resourceful individuals who can work in dynamic environments.

Network and Community Management Tools

These platforms allow VC firms to build relationships, share insights, and exchange ideas with entrepreneurs, co-investors, and industry experts. These tools help VCs expand their professional networks, access valuable resources, and stay updated on industry developments, ultimately enhancing their ability to make strategic investment decisions and drive portfolio success.

- Pinched.io — Pinched.io is a network and community management tool for VCs focusing on curated content and targeted discussions. VC firms can connect with relevant stakeholders, access valuable insights, and build meaningful relationships, driving portfolio success in a competitive landscape.

- Melting Spot — Melting Spot is another network and community management tool for VC firms with a dedicated space for collaboration and engagement. It offers customizable features and integrated analytics that allow VCs to optimize networking strategies, and drive long-term success.

General tools

General tools include regular business tools that enhance productivity, collaboration, data management, and marketing efforts for investors.

Note-taking and Knowledge Management:

- Evernote: For capturing and organizing notes, ideas, and research.

- Notion: For note-taking, project management, and collaboration.

Productivity and Collaboration:

- Slack: Messaging platform for team communication and collaboration.

- Microsoft Teams: Collaboration hub in Office 365 for chat, meetings, and file sharing.

- Asana: Project management tool for tracking tasks, deadlines, and team projects. David Teten, a popular name in the VC industry, uses Asana for managing activities.

- Trello: Visual collaboration tool for organizing tasks and projects using boards.

Data Rooms:

- Intralinks: Secure virtual data rooms for managing due diligence and deal documents.

- Box: Cloud content management and collaboration platform for securely sharing files.

- DocSend: Secure document sharing and collaboration platform for teams.

Marketing Stack:

- HubSpot: Marketing, sales, and CRM platform for managing customer relationships.

- Mailchimp: Email marketing platform for designing, sending, and tracking email campaigns.

- Buffer: Social media management platform for scheduling and analyzing social media posts.

- Goodbit: For managing cryptocurrency investments, tracking portfolios, and analyzing market trends.

HR Stack:

- BambooHR: HR software for managing employee data, onboarding, and performance reviews.

- Gusto: Online payroll and HR platform for managing payroll, benefits, and compliance.

- Workday: Cloud-based HR and finance software for managing HR, payroll, and talent management processes.

Below is a summarized table with links to all these tools for your reference:

Conclusion

A modern VC relies on diverse tools to invest with precision and agility. From CRM and deal flow management platforms like Affinity and Salesforce to sophisticated sourcing platforms such as Synaptic and Harmonic, each tool is vital in streamlining operations and driving better investment outcomes. The difference between a good and bad data stack can cost you immeasurably. With the right combination of tools tailored to your specific requirements, you can enhance their decision-making processes, optimize workflows, and maximize returns on investment. We hope this guide helped you understand what to look for while selecting these tools for your business.