Webinar

•

May 21, 2024

Becoming More Data-Driven in 2024

Duration: 59 minutes

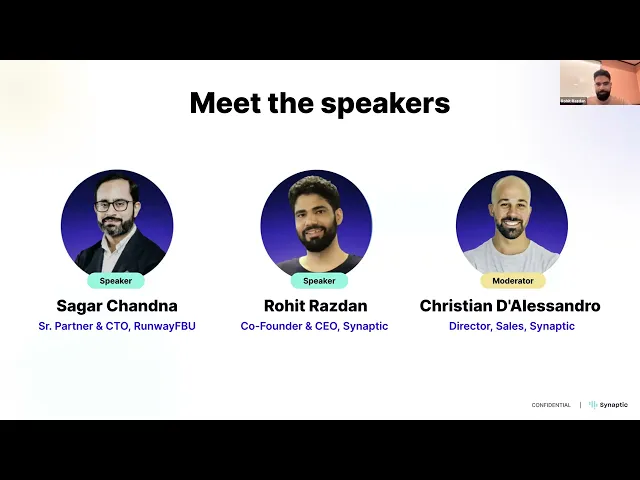

Christian (Sales Lead), Rohit (CEO & Co-founder), and Sagar Sarin (Partner & CTO at Runway FBU, recognized among the top 100 data-driven VC voices globally) discuss what being data-driven actually means in 2024 and how to do it right.

TL;DR:

Why it matters: Teams are drowning in deal flow while missing great companies outside their networks. Data brings structure to sourcing, screening, selecting, and scaling—reducing bias and making decisions traceable.

The adoption barrier: Technology isn't the problem—team buy-in is. Cultural alignment comes first. Track everything, prove value with results, then scale. Manual processes fail when teams don't use them.

Build vs buy: Build first to learn what you need, then buy the plumbing. Maintenance infrastructure eats engineering bandwidth. Buy integrations, build your differentiation.

AI's real role today: Document summarization and filtering millions of companies to hundreds worth evaluating. LLMs hit 85% accuracy without oversight—not enough for venture. The solution is AI for speed, humans for context.

The opportunity: Layer AI over your private data advantage. Extract metrics from board decks, structure meeting notes, turn unstructured inputs into searchable insights. Small efficiencies compound across quarters.

Transcript:

[00:00:03 – 00:03:25] Christian:

We’re live. We’ll give folks a minute to trickle in, then cover housekeeping and today’s plan. We’ll focus on why and how to become data-driven with perspectives from Rohit and Sagar. We’ll keep it interactive—drop questions in the Q&A; we’re recording and will share the link. I’m Christian De Alesandro, based in New York, leading Sales at Synaptic. Before this, I spent nearly six years at CB Insights, where I saw how investors think about private-market data and how their workflows evolve over time.

[00:03:25 – 00:04:03] Sagar:

I’m Sagar Sarin, Partner and CTO at Runway FBU, an early-stage VC firm based in Norway. We invest in software-driven tech companies across Europe, particularly those tackling complex, industrial problems. I’ve worked with several other funds and invested in more than a hundred startups globally. Before venture, I was at a global browser company—so I’ve experienced both sides of the table, the operator and the investor.

[00:04:03 – 00:04:35] Christian:

Quick note for everyone—Sagar was recently recognized among the top 100 data-driven VC voices globally. Definitely worth following his writing if you’re interested in where data meets venture investing. Rohit, over to you.

[00:04:35 – 00:05:28] Rohit:

Thanks, Christian. I’m Rohit, Co-founder and CEO of Synaptic. I come from a technology and programming background. Before Synaptic, I led tech at Vy Capital, where I worked on using data to improve investment decisions. That experience inspired Synaptic. Our goal has always been simple—help investors make better, faster, more objective decisions with data. The tools and datasets evolve every few years, but the fundamentals of being data-driven haven’t changed. Today, we’ll revisit those fundamentals and explore what’s actually new as we move into 2024.

[00:05:37 – 00:06:08] Christian:

Let’s start from the top. The phrase “data-driven” gets thrown around so much it’s almost lost meaning. What does it really mean for a fund, and where’s the value?

[00:06:08 – 00:08:02] Sagar:

To me, being data-driven means applying data systematically across the entire investing pipeline—sourcing, screening, selecting, and scaling. Those steps are still heavily human-driven, which makes them slow, subjective, and difficult to scale. Data and technology bring structure. They speed up repetitive work while improving reliability, transparency, and repeatability. It’s not about replacing human intuition—it’s about reducing bias, creating traceability, and making your decision-making process more objective and scalable.

[00:08:11 – 00:09:20] Rohit:

That’s a great framing. Venture is and will always be a people business, but removing bias is both profitable and fair. Data helps funds evolve—from intuition-driven to evidence-driven. It allows funds to surface companies and founders who might otherwise be overlooked, especially those outside existing networks.

[00:09:20 – 00:10:51] Sagar:

Exactly. Two reasons make this crucial. First, manpower isn’t scaling with deal flow. Analysts and partners are getting buried under the volume of startups. Second, without structured data, you risk missing great companies because they don’t fit familiar narratives or geography. Data helps you focus attention where it truly matters.

[00:11:23 – 00:13:09] Sagar:

At Runway FBU, our data-driven journey started by setting clear goals and aligning culturally as a team. Everyone had to understand why we were collecting data. Once that alignment was there, we began tracking everything—emails, meetings, even small engagement signals like who clicks our signature links. Not everything is useful immediately, but over time those breadcrumbs become valuable. You can test what correlates with success and refine your model. The biggest barrier to being data-driven isn’t technology—it’s adoption. If the team doesn’t use the system, the system fails.

[00:14:36 – 00:16:18] Sagar:

Was there resistance at first? Absolutely. Manual enrichment felt tedious before we automated parts of it. But the breakthrough came from proof. We showed LPs and internal teams the difference it made—the clarity of insights, the improved communication, and eventually, how portfolio outcomes improved once decisions became more evidence-based.

[00:16:34 – 00:18:06] Rohit:

That’s a key point. Technology is secondary; design for humans is what drives adoption. Back when I was at Vy Capital, our inflection point wasn’t building scrapers or models—it was creating a usable internal platform that people genuinely wanted to use. Once we made data accessible to everyone, it changed how the team operated. That philosophy directly influenced how we built Synaptic.

[00:19:11 – 00:20:08] Sagar:

On build-versus-buy: I’ve learned to build first to learn what to buy. Sometimes you don’t even know what features you truly need until you’ve tried building something lightweight. But equally, don’t overbuild. If a tool exists and solves 80% of your need, buy it. Your time is better spent on differentiation, not plumbing.

[00:20:26 – 00:23:15] Rohit:

That’s wise advice. Experienced funds lean toward buying more because they’ve lived through the pain of maintaining infrastructure. APIs change, integrations break, and maintaining a data stack can eat half your engineering bandwidth. Our rule of thumb: buy the plumbing, build the brain. Let others handle the messy integrations. Focus your build effort where your insights, workflows, and strategy are unique.

[00:23:58 – 00:28:00] Sagar:

Yes, think end-to-end. Data moves through a lifecycle—ingest, transform, use, report, archive. If your tools don’t connect seamlessly through that chain, you’ll waste half your effort on reconciliation. The good news is the ecosystem is improving. Three years ago, connecting CRMs to analytics dashboards was painful. Today, the integrations are easier and the focus should be on interoperability. Design from the start so your data compounds rather than fragments.

[00:33:02 – 00:37:00] Sagar:

Let’s talk about generative AI—it’s everyone’s favorite question. What’s real today is document summarization and filtering large universes into relevant subsets. If you have 10 million companies, AI can help you narrow to the 100 worth evaluating. But the myth that AI will autonomously choose investments is unrealistic. Every fund has its own thesis, mandate, and network context. What AI can do today is enrich and structure private data—turn unstructured updates, meeting notes, or research into searchable insights. That’s the immediate opportunity.

[00:37:24 – 00:41:00] Rohit:

We’re pragmatic optimists about AI. LLMs can extract metrics from board decks, summarize meeting notes, even read charts. But current models cap around 85% accuracy without supervision—and that last 15% is crucial in venture. The solution is AI plus human oversight. AI gets you speed and scale; humans provide context and quality control. It’s easy to make a great demo, harder to make a reliable product. Trust is what separates them.

[00:41:18 – 00:45:00] Sagar:

Trust is the right word. AI is useful where its reliability can be measured. Accept that hallucinations exist, and layer AI over your private data advantage. You don’t need AGI to start; small, practical efficiencies compound. Each saved hour adds up across quarters and portfolios.

[00:45:12 – 00:46:02] Christian:

That’s a perfect point to close on. Being data-driven isn’t about having the most tools—it’s about combining automation and human judgment intelligently.

[00:46:02 – 00:46:35] Rohit:

Exactly. The best investors are learning machines. Data is how you scale that learning.

[00:46:35 – 00:47:10] Christian:

Thanks to everyone who joined today. We’ll share the recording and transcript shortly. Sagar, Rohit—thank you both for the time and insights.

[00:47:10 – 00:47:25] Rohit:

Thanks, Christian. And thanks to everyone listening—appreciate the energy and curiosity.